Next-Generation AI-Powered DEX to TRADE, STAKE & MAXIMIZE Your Crypto.

Intelligent trading algorithms, automated yield optimization, and seamless staking rewards. Experience the future of decentralized finance with AI-driven insights and maximum returns

TRADE SMARTER WITH 0% SLIPPAGE GUARANTEE

Harness the power of AI-driven market analysis and intelligent order routing. Our advanced algorithms automatically find the best prices across multiple liquidity pools, ensuring optimal execution and maximum value for every trade.

Intelligent crypto staking solutions

Get maximum yields with minimum effort through our AI-optimized staking strategies and automated reward compounding.

| AI-powered | Tradi-Stake | |

|---|---|---|

AI-Optimized Yields | ||

Automated Compounding | ||

Multi-Chain Support | ||

Real-Time Analytics | ||

Instant Unstaking | ||

Zero Setup Fees | ||

24/7 AI Monitoring |

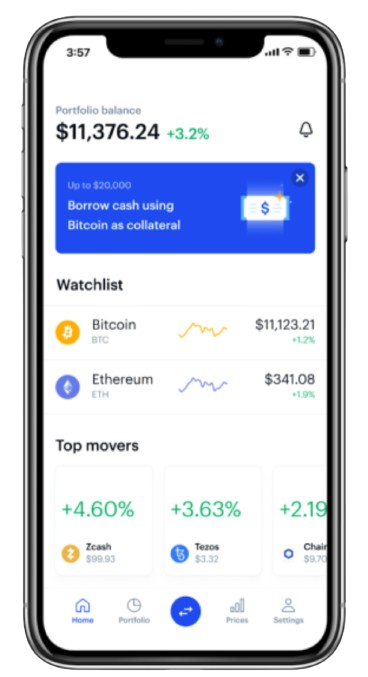

ALL IN ONE SOLUTION FOR CRYPTOCURRENCY

Convenience and Accessibility

Users can access a wide range of decentralized financial services, including loans, synthetic tokens, investments, and more, all from a single platform. This eliminates the need to interact with multiple protocols and applications, making the experience more convinient and accessible.

Cost Efficiency

By having multiple services under one roof, users can save on commissions and transaction fees that would otherwise be generated by moving assets between different platforms. Cost efficiency translates into greater profitability for users.

Simplified portfolio diversity

The platform offers the ability to diversify investments and access a wide range of traditional and synthetic assets. This allows users to manage their portfolios more effectively and distribute risk intelligently.

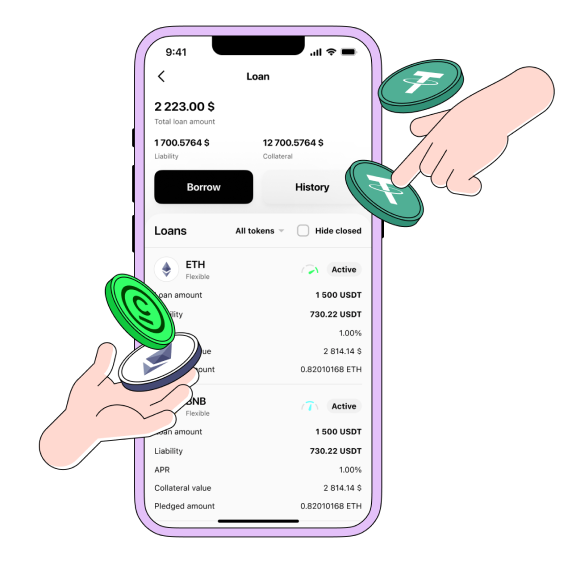

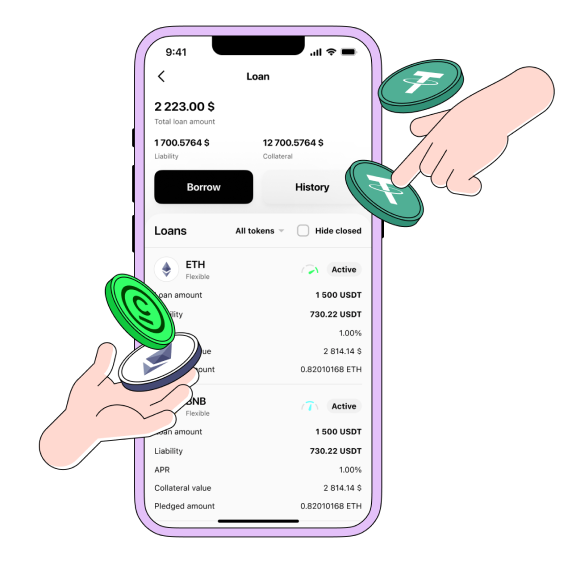

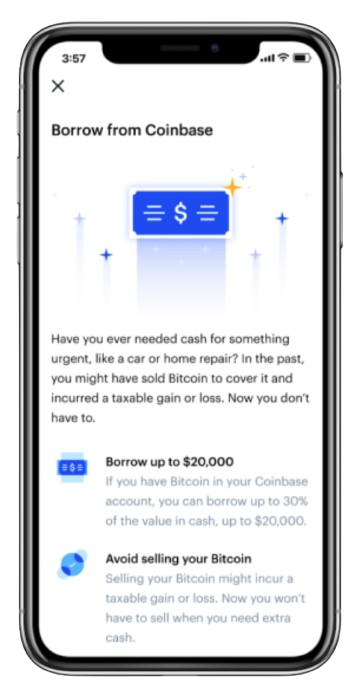

HOW TO BEST UTILISE YOUR CREDIT LINE

With a minimum of $50 and a maximum of $2M, Defi connect credit is here to help you afford the necessities and luxuries you are thinking about.

Buy more Crypto

Make a major project

Optimise your project

Make a major project

MORE WAYS TO GET THE BEST OUT OF DEFI CONNECT CREDIT

AI-powered DEX (Decentralized Exchange)

AI algorithms continuously optimize your trading and staking strategies.

Stake Pool

Stake and multiply your yields through our innovative tokenomics system. Lock tokens longer for higher rewards while shaping protocol decisions.

RWA (Real World Assets)

Access real-world investment opportunities through DeFi. Earn stable yields backed by vetted traditional assets while maintaining crypto liquidity.

TEAM

Federico Tula

Co-founder

Hailing from Argentina, Federico brings a wealth of experience spanning numerous projects. With a crypto journey dating back to 2016, they've engaged with various projects at different capacities. Their collaboration with us aims to infuse our endeavor with enriched experience, valuable insights, and extensive networks, bolstering its appeal and robustness.

Shazili Uthman

Business Developer

Shazili has over a decade of experience in financial technology, having previously led successful blockchain projects. He brings a strategic vision for merging traditional finance with decentralized technologies.

Godfrey

Software Engineer

Godfrey is a seasoned software engineer that also specializes in DevOps. With a strong background in computer science, he oversees the technical aspects of the project.

FAQS

DEFI CONNECT CREDIT 2025 ROADMAP

Core Mission

Development and Community Engagement

Q1 {2025}

Finalize and test the Borrow and Lending platform on the testnet. Launch ve(3,3) DEX in closed beta with a small group of testers. Implement an incentivized Testnet Campaign for Borrow and Lending and DEX, offering rewards to users for feedback and bug reporting. Begin foundational work for RWA tokenization, focusing on integrating the first pilot assets. Introduce a comprehensive community engagement program, including educational campaigns.

Q2 {2025}

Official public launch of the Borrow and Lending platform. Public launch of ve(3,3) DEX, enabling governance, token swaps, and liquidity provision. Finalize development of RWA smart contracts and begin onboarding initial real estate and stock assets in collaboration with local agents. Launch an enhanced marketing strategy targeting regional markets (e.g., LATAM and Asia) to boost adoption. Initiate discussions for strategic partnerships to expand the range of tokenized assets available on the platform.

Expansion and RWA Stock Trading

Q3 {2025}

Launch the first RWA tokens on the platform, providing access to tokenized real estate and stock assets. Develop advanced features for trading tokenized stock assets, ensuring compliance with global regulatory standards. Upgrade platform infrastructure to handle increased traffic and asset volume securely and efficiently. Expand community-driven governance on ve(3,3) DEX by introducing voting for new pairs and protocol features. Collaborate with strategic partners for joint marketing efforts and liquidity sharing.

Q4 {2025}

Expand the RWA trading platform to include additional tokenized assets such as precious metals and commodities based on community feedback. Release advanced analytics and reporting tools for platform users to better manage their assets. Evaluate and initiate the process of seeking regulatory approval to operate as a compliant entity in key markets. Plan and announce roadmap updates for 2026, incorporating user feedback and market conditions.

Partners

CONTACT US

Defi Connect Credit

Company Info

About Us

Careers

RESOURCES

Blog

LEGAL

Privacy policy

Terms & Conditions

All or part of the Defi Connect Credit services, some featues thereof, orsome digital assests, are not available in certain jurisdictions, including where restrictions or limitations may apply, as indicated on the Defi connect platform and in the relevant general terms and conditions.

©2025 DefiConnect All Rights Reserved